¶ Getting Started

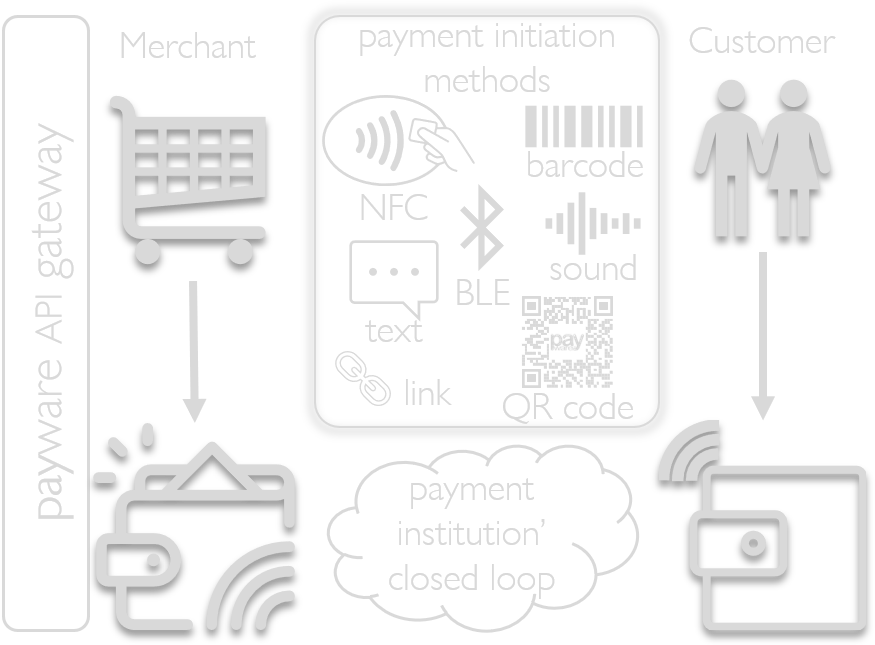

payware is a multi-sided payment initiation and information exchange platform for merchants, e-commerce, payment institutions and service providers. With a large array of features, partners are equipped with the tools they need to make and accept mobile payments. Partners can utilize payware platform features through multiple online and offline channels.

payware provides you with a range of powerful connection and integration technologies, user-friendly client portal, and convenient reporting and business intelligence tools that are simple and easy to use. These were designed to eliminate the technical complexity and difficulty that many clients and partners typically encounter when trying to conduct cashless commerce, and they are designed to require minimum effort to implement and use.

payware proprietary APIs are publicly published. They provide a set of programming instructions and standards to access and connect to the platform. A set of SDKs and developer tools are available, including an MCP server for AI-assisted development, which provide software development tools, code and documentation to help third-party developers integrate with the platform.

¶ Documentation

Get familiar with payware integration resources and explore their features. payware supports APIs for in-person payments for your proprietary POS software and hardware; online payments with payware Checkout; in-app payments for native Android and iOS apps as well as offline payment model. Depending on your case, you can follow the guides below or contact payware for any questions you may have.

¶ Target audience

This documentation is intended for merchants, payment institutions (business) and developers or integrators (tech).

The key steps below are split into the following flows – business (legal and commercial) and technical (integration and testing).

Register before doing technical steps. This will enable access to resources unreachable for unregistered users.

For complex business cases, we recommend to contact us.

¶ What do you need?

| Audience | I need to… | Solution |

|---|---|---|

| Small businesses, street-vendors, taxi drivers and pay-on-delivery professionals | Accept payments without having internet connectivity | Register and review the offline user guide |

| E-commerce website operators | Accept payments from a website | Register and review the checkout options |

| Independent Software Vendors Enterprises with proprietary POS systems |

Create alternative to POS terminal payment acceptance channel | Register and review the integration options |

| Payment institutions | Enable payments outside the card networks for my customers | Payment institution enablement |

¶ Next steps

Now we make a split between business and tech steps. If you are involved in the application or contract, follow the business steps. If you are involved in the technical integration, go to the tech steps.